Advertisement

-

Published Date

June 1, 2018This ad was originally published on this date and may contain an offer that is no longer valid. To learn more about this business and its most recent offers, click here.

Ad Text

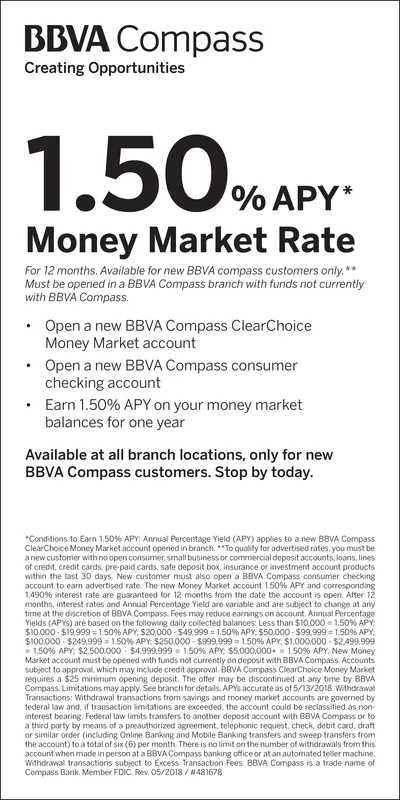

BBVA Compass Creating Opportunities %APY* Money Market Rate For 12 months. Availablefor new BBVA compass customers only.* Must be opened in a BBVA Compass branch with funds not currently with BBVA Compass. Open a new BBVA Compass ClearChoice Money Market account . .Open a new BBVA Compass consumer checking account Earn 1.50% APY on your money market balances for one year Available at all branch locations, only for new BBVA Compass customers. Stop by today Conditions to Earn 1.50% APY: Annual Percentage Yield (APY) applies to a new BBVA Compass ClearChoice Money Market account opened in branch To quality for advertised rates, you must be a new customer with noopen consumer, small business or commercial deposit accounts, loans, lines of credt, credit cards, pre-paid cards, safe deposit box, insurance or investment account products within the last 30 days. New customer must also open a BBVA Compass consumer checking account to earn advertised rate. The new Money Market account 1 50% APY and corresponding 1.490% interest rate are guaranteed for 12 months from the date the account is open. After 12 months, interest rates and Annual Percentage Yield are variable and are subject to change at any time at the discretion of BBVA Compass. Fees may reduce earnings on account,Annual Percentage Yields (APY's) are based on the follow ng daily collected balances: Less than $10.000 # 1.50% APY; $10.000-$19.999 # 1.50% APY; $20,000-$49.999 1.50% APY; $50.000-$99.999 1.50% APY; $100.000 . $249.999 ; 1.50% APY; $250.000-$999.999-1 50% APY: $1,000,000-$2.499.999 3.50% APY. $2.500.000 . $4.999.999 1.50% APY $5.000.000+ 1.50% APY. New Money Market account must be opened with funds not currently on deposit with BBVA Compass. Accounts subject to approval, which may include credit approval, BBVA Compass ClearChoice Money Market requires a $25 minimum opening deposit. The offer may be discontinued at any time by BBVA Compass. Limitations may apply. See branch for details. APYs accurate as of 5/13/2018 Withdrawal Transactions: Withdrawal tranisactions from savings and money market accounts are governed by federal law and, if transaction mstations are exceeded, the account could be reclassified as non interest bearing. Federal law limits transfers to another deposit account with BBVA Compass or to a third party by means of a preauthorized agreement, telephonic request, check, debit card, draft or similar order (including Online Banking andd Mobile Banking transfers and sweep transters from the account) to a total of six (6) per month. There is no limit on the number of withdrawals from this account when made in person at a BBVA Compass banking office or at an automated teller machine. Withdrawal transactions subject to Excess Transaction Fees. BBVA Compass is a trade name of Compass Bank. Merter FDIC, Rev. 05/2O18 / #481678