Advertisement

-

Published Date

August 12, 2020This ad was originally published on this date and may contain an offer that is no longer valid. To learn more about this business and its most recent offers, click here.

Ad Text

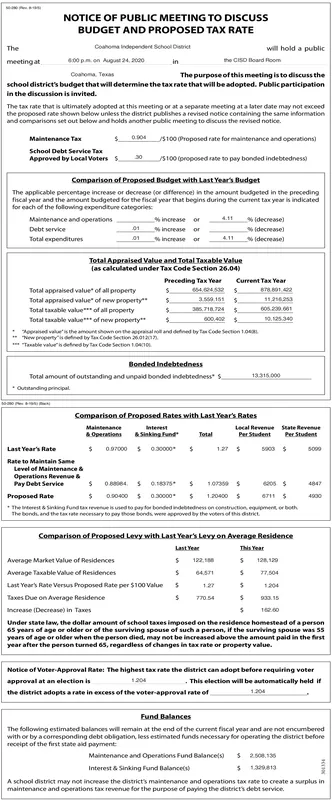

NOTICE OF PUBLIC MEETING TO DISCUSS BUDGET AND PROPOSED TAX RATE The Coanoma independert Sohooi Daiet will hold a public 600 pm.on Auguat 24, 2000 the CISD Board Room meeting at in Coahoma. Texas The purposeof this meeting is to discuss the school district's budget that will determine the tax rate that will beadopted. Public participation in the discussion is invited. The tax rate that is ultimately adopted at this meeting or at a separate meeting at a later date may not exceed the proposed rate shown below unless the district publishes a revised notice containing the same information and comparisons set out below and holds another publie meeting to discus the revised notice. 004S100Proposed rate for maintenance and operations Maintenance Tax School Debt Service Tax Approved by Local Voters S 30 JS100 (proposed rate to pay bonded indebtedness Comparison of Proposed Budget with Last Years Budget The applicable percentage increase or decrease (or diferencel in the amount budgeted in the preceding fncal year and the amount budgeted for the fiscal year that begins during the current tax year is indicated for each of the following expenditure categories Maintenance and operations % increase or 4.1 Idecrease) Debt service 01 increase or idecrease) Total expenditures Idecreane) S increase or 4.11 Total Appraised Value and Total Taxable Value (as calculated under Tax Code Section 26.04) Preceding Tax Year Current Tax Year sta st Total appraised value of all property 1122 Total appraised value" of new property Total taxable value* of all property 5.718724 $ 60s.20.001 Total taxable value* of new property e0040 S 10.25.340 * "Aoprased vales the ameunt shownon the prsal anddened ty Ta Code Secton 10 Tew propetys dened by ta Code Section 2001n "Tanable valurndetredty ta Codde Section Bonded Indebtedness Total amount of outstanding and unpaid bonded indebtedness S 13315.000 * Outtanding prnipal Comparison of Proposed Rates with Last Year's Rates Maintenance nterest Lecal Revenue State Revenue Per Student A.Operations ASinking fund Total Per Student Last Year's Rate 5009 Rate to Maintain Same Level of Maintenance & Operations Revenue Pay Debt Service 4647 Proposed Rate * 00040 $ o 30000 S 120400 S 400 *The Interest Sanang fundan revenue isused to pay bonded indetedres on costrution pment or beth The bends. and the ta ate neonsary to pry those bonds were approved by the voters of this datrict. Comparison of Proposed Levy with Last Year's Levy on Average Residence Last Year This Year Average Market Value of Residences S 122. $ 128, 129 Average Taxable Value of Residences 7.504 $ 1204 S 033. 15 Last Yoar's Rate Versus Proposed Rate per $100 Value s 127 Taxes Due on Average Residence 770 54 Increase (Decrease) in Taxes 162.00 Under state law, the dollar amount of school taxes imposed on the residence homestead of a person 65 years of age or older or of the surviving spouse of such a person, if the surviving spouse was 55 years of age or older when the person died, may not be increased above the amount paid in the first year after the person turned 65, regardless of changes in tax rate or property value. Notice of Voter-Approval Rate: The highest tax rate the district can adopt before requiring voter approval at an election is This election will be automatically held if the district adopts a rate in excess of the voter-approval rate of 1204 Fund Balances The following estimated balances will remain at the end of the current fical year and are not encumbered with or by a corresponding debt obligation, less estimated funds necessary for operating the district before receipt of the first state aid payment Maintenance and Operations Fund Balancelo S 2.50,13 Interest & Sinking Fund Balancets $ 132013 A school distrit may not increase the district's maintenance and operations tax rate to create a surplus in maintenance and operations tax revenue for the purpose of paying the districts debt service. NOTICE OF PUBLIC MEETING TO DISCUSS BUDGET AND PROPOSED TAX RATE The Coanoma independert Sohooi Daiet will hold a public 600 pm.on Auguat 24, 2000 the CISD Board Room meeting at in Coahoma. Texas The purposeof this meeting is to discuss the school district's budget that will determine the tax rate that will beadopted. Public participation in the discussion is invited. The tax rate that is ultimately adopted at this meeting or at a separate meeting at a later date may not exceed the proposed rate shown below unless the district publishes a revised notice containing the same information and comparisons set out below and holds another publie meeting to discus the revised notice. 004S100Proposed rate for maintenance and operations Maintenance Tax School Debt Service Tax Approved by Local Voters S 30 JS100 (proposed rate to pay bonded indebtedness Comparison of Proposed Budget with Last Years Budget The applicable percentage increase or decrease (or diferencel in the amount budgeted in the preceding fncal year and the amount budgeted for the fiscal year that begins during the current tax year is indicated for each of the following expenditure categories Maintenance and operations % increase or 4.1 Idecrease) Debt service 01 increase or idecrease) Total expenditures Idecreane) S increase or 4.11 Total Appraised Value and Total Taxable Value (as calculated under Tax Code Section 26.04) Preceding Tax Year Current Tax Year sta st Total appraised value of all property 1122 Total appraised value" of new property Total taxable value* of all property 5.718724 $ 60s.20.001 Total taxable value* of new property e0040 S 10.25.340 * "Aoprased vales the ameunt shownon the prsal anddened ty Ta Code Secton 10 Tew propetys dened by ta Code Section 2001n "Tanable valurndetredty ta Codde Section Bonded Indebtedness Total amount of outstanding and unpaid bonded indebtedness S 13315.000 * Outtanding prnipal Comparison of Proposed Rates with Last Year's Rates Maintenance nterest Lecal Revenue State Revenue Per Student A.Operations ASinking fund Total Per Student Last Year's Rate 5009 Rate to Maintain Same Level of Maintenance & Operations Revenue Pay Debt Service 4647 Proposed Rate * 00040 $ o 30000 S 120400 S 400 *The Interest Sanang fundan revenue isused to pay bonded indetedres on costrution pment or beth The bends. and the ta ate neonsary to pry those bonds were approved by the voters of this datrict. Comparison of Proposed Levy with Last Year's Levy on Average Residence Last Year This Year Average Market Value of Residences S 122. $ 128, 129 Average Taxable Value of Residences 7.504 $ 1204 S 033. 15 Last Yoar's Rate Versus Proposed Rate per $100 Value s 127 Taxes Due on Average Residence 770 54 Increase (Decrease) in Taxes 162.00 Under state law, the dollar amount of school taxes imposed on the residence homestead of a person 65 years of age or older or of the surviving spouse of such a person, if the surviving spouse was 55 years of age or older when the person died, may not be increased above the amount paid in the first year after the person turned 65, regardless of changes in tax rate or property value. Notice of Voter-Approval Rate: The highest tax rate the district can adopt before requiring voter approval at an election is This election will be automatically held if the district adopts a rate in excess of the voter-approval rate of 1204 Fund Balances The following estimated balances will remain at the end of the current fical year and are not encumbered with or by a corresponding debt obligation, less estimated funds necessary for operating the district before receipt of the first state aid payment Maintenance and Operations Fund Balancelo S 2.50,13 Interest & Sinking Fund Balancets $ 132013 A school distrit may not increase the district's maintenance and operations tax rate to create a surplus in maintenance and operations tax revenue for the purpose of paying the districts debt service.